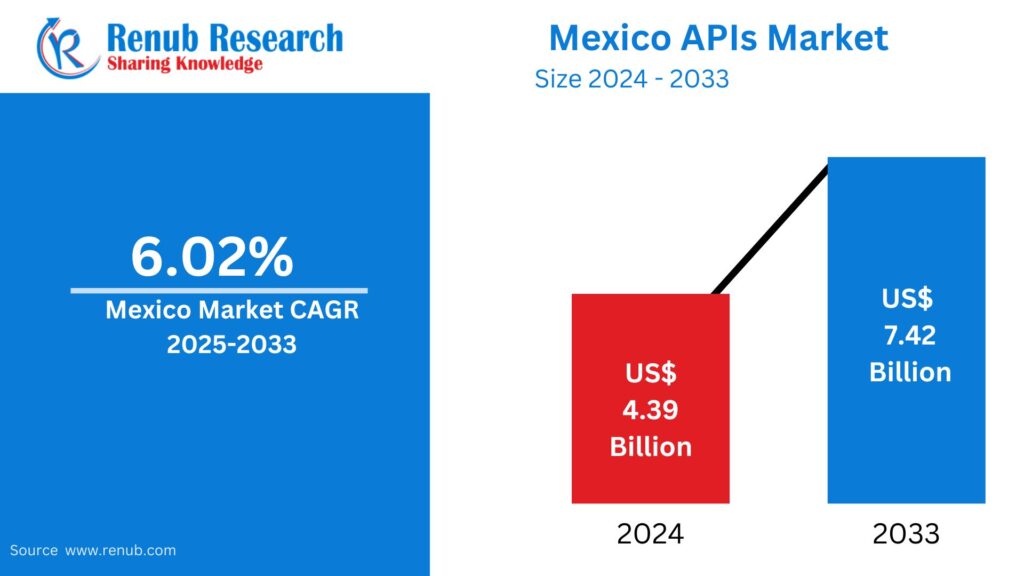

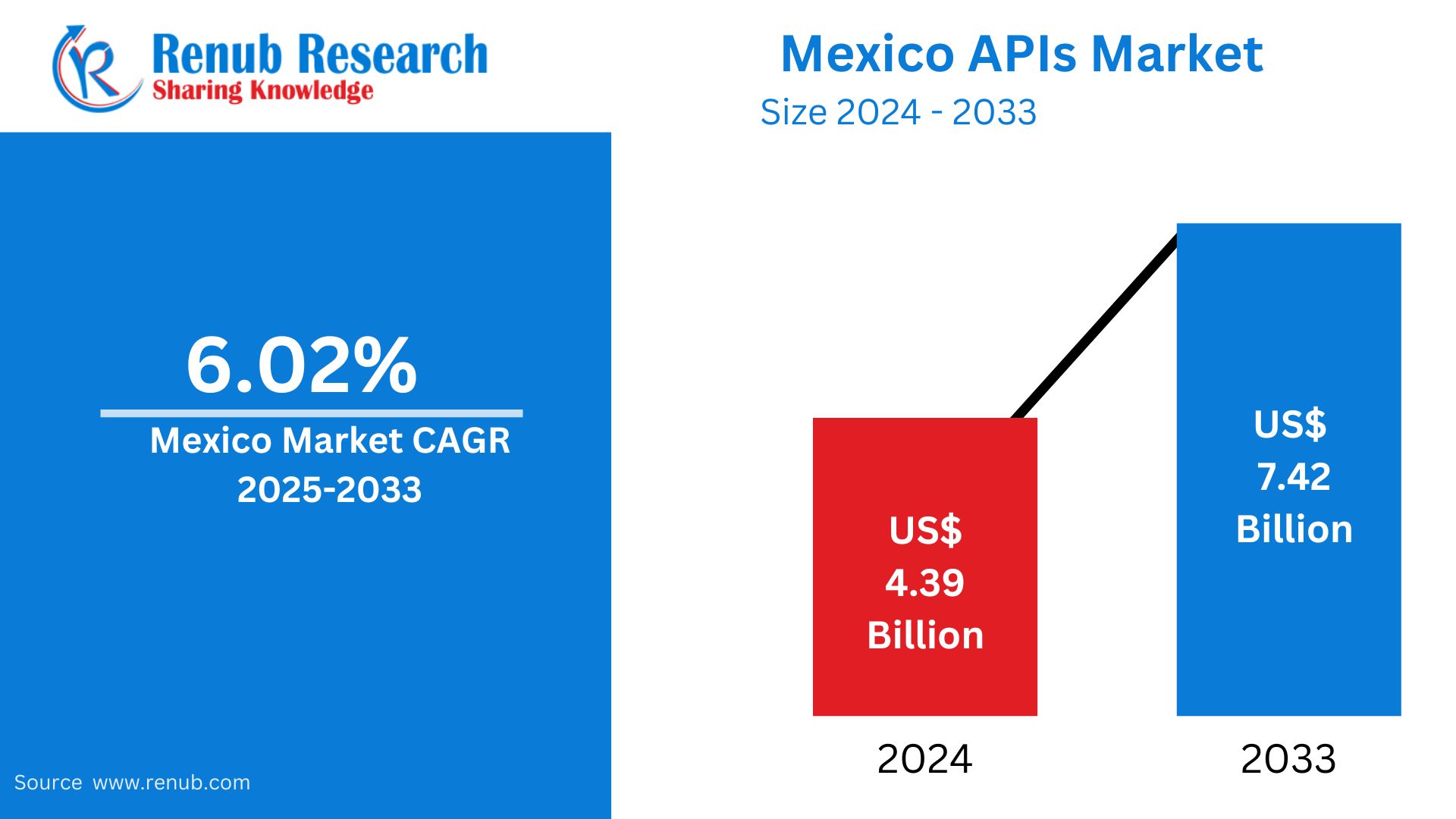

Mexico Active Pharmaceutical Ingredients Market Size and Forecast 2025–2033

According To Renub Research Mexico Active Pharmaceutical Ingredients (API) market is projected to witness solid and sustained growth over the forecast period, supported by structural changes in the pharmaceutical supply chain and rising domestic healthcare demand. The market is expected to expand from approximately US$ 4.39 billion in 2024 to nearly US$ 7.42 billion by 2033, registering a compound annual growth rate of about 6.02% between 2025 and 2033. This growth trajectory is driven by increasing consumption of generic medicines, rising prevalence of chronic diseases, expansion of pharmaceutical manufacturing capacity, and strong government initiatives aimed at strengthening domestic API production and reducing reliance on imports.

Mexico is increasingly positioning itself as a strategic pharmaceutical manufacturing hub in Latin America. Its geographic proximity to the United States, skilled workforce, and participation in key trade agreements are encouraging multinational and domestic pharmaceutical companies to invest in API manufacturing. As global supply chains continue to prioritize resilience and nearshoring, Mexico’s API market is expected to play a more prominent role in both regional and international pharmaceutical ecosystems.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=mexico-active-pharmaceutical-ingredients-market-p.php

Mexico Active Pharmaceutical Ingredients Market Overview

Active Pharmaceutical Ingredients are the biologically active components in pharmaceutical drugs that produce the intended therapeutic effects. APIs are essential to the formulation of both branded and generic medicines and form the foundation of treatments for a wide range of conditions, including cardiovascular diseases, diabetes, cancer, neurological disorders, and infectious diseases. APIs can be manufactured through chemical synthesis, fermentation, or biotechnology-based processes and are later combined with excipients to produce finished dosage forms such as tablets, capsules, and injectables.

In Mexico, API demand continues to grow steadily due to the expansion of the domestic pharmaceutical manufacturing sector and rising consumption of medicines across public and private healthcare systems. Mexico is one of the largest pharmaceutical producers in Latin America, benefiting from favorable trade agreements, regulatory alignment with major markets, and a well-established industrial base. Government-led initiatives to promote local API production and strengthen supply chain security are further accelerating market development. Additionally, improved access to healthcare and a growing burden of chronic diseases are increasing demand for affordable, high-quality medicines, reinforcing the importance of a robust API industry.

Drivers of Growth in the Mexico Active Pharmaceutical Ingredients Market

Rising Demand for Generic Medicines

Generic drugs form the backbone of Mexico’s healthcare system, particularly within public hospitals and social security programs that aim to provide cost-effective treatment to a large population. The rising prevalence of chronic conditions such as diabetes, hypertension, and cardiovascular diseases has intensified demand for affordable long-term therapies, significantly boosting the need for APIs used in generic formulations.

Government policies actively promote the use of generics to reduce healthcare expenditure and expand treatment access. This strong institutional support, combined with growing demand from both domestic and export-oriented pharmaceutical companies, is driving increased consumption and production of APIs. As Mexico strengthens its position as a leading generic drug manufacturer in Latin America, the API market benefits directly from this expanding production base.

Government Initiatives Supporting Local API Manufacturing

Reducing dependence on imported APIs has become a strategic priority for Mexico, particularly following global supply chain disruptions in recent years. The government has introduced a range of supportive measures, including tax incentives, infrastructure development, research funding, and streamlined regulatory processes, to encourage local API manufacturing.

These initiatives aim to enhance national pharmaceutical self-sufficiency while improving supply chain resilience. Public procurement commitments and closer coordination between health authorities and the pharmaceutical industry have further strengthened market confidence. As a result, both domestic and international companies are investing in new facilities, upgrading existing plants, and adopting global quality standards, creating a favorable environment for sustained API market growth.

Expansion of Pharmaceutical Exports and Trade Integration

Mexico’s participation in trade agreements such as the USMCA has significantly improved its access to major pharmaceutical markets, particularly the United States and Canada. Pharmaceutical companies seeking nearshoring opportunities increasingly view Mexico as an attractive alternative to distant manufacturing locations.

Regulatory alignment with international standards and improved manufacturing capabilities have enhanced the export potential of Mexican APIs. Collaborations with multinational pharmaceutical firms are facilitating technology transfer, quality improvements, and capacity expansion. Export-driven growth is therefore playing a critical role in strengthening Mexico’s API market and positioning the country as a competitive global supplier.

Challenges in the Mexico Active Pharmaceutical Ingredients Market

Continued Dependence on Imported APIs

Despite progress toward localization, Mexico still relies heavily on API imports, particularly from Asian suppliers. This dependence exposes the pharmaceutical sector to risks such as supply disruptions, price volatility, and geopolitical uncertainty. Imported raw materials and intermediates also reduce domestic control over critical components of the medicine supply chain.

While government incentives are gradually addressing this issue, establishing a fully self-sufficient API manufacturing ecosystem requires substantial capital investment, technological expertise, and time. Until local capacity reaches scale, import reliance will remain a structural challenge for the market.

Regulatory and Quality Compliance Constraints

Compliance with international regulatory standards poses a significant challenge for many Mexican API manufacturers, especially small and medium-sized enterprises. Meeting Good Manufacturing Practice requirements, implementing advanced quality control systems, and navigating complex approval processes can be costly and resource-intensive.

These barriers may limit the ability of local manufacturers to compete globally or enter highly regulated export markets. Inadequate infrastructure or outdated facilities can further restrict scalability and partnership opportunities. Strengthening regulatory capabilities and upgrading production facilities remain essential to sustaining long-term market growth.

Mexico Generic Active Pharmaceutical Ingredients Market

The generic API segment represents a major growth engine within the Mexican API market. Strong government preference for generic medicines and rising demand for affordable treatments are driving increased production of APIs used in widely prescribed drugs for chronic and infectious diseases.

Mexico’s cost-competitive manufacturing environment and proximity to North American markets make it an attractive destination for generic API production. Export demand from regional and international pharmaceutical companies further supports this segment, reinforcing its importance within the overall API landscape.

Mexico Biotech Active Pharmaceutical Ingredients Market

The biotech API segment in Mexico is still emerging but holds significant long-term potential. Biotech APIs, derived from biological sources, are essential for producing biologics and biosimilars used in treating complex conditions such as cancer, autoimmune disorders, and rare diseases.

Although this segment requires higher investment in research, development, and specialized manufacturing infrastructure, growing collaboration between private companies, academic institutions, and international partners is fostering innovation. As demand for biologic therapies increases, the biotech API market is expected to gain momentum over the forecast period.

Mexico Captive Active Pharmaceutical Ingredients Market

Captive API manufacturing, where pharmaceutical companies produce APIs for internal use, is gaining traction in Mexico. This model allows companies to maintain greater control over quality, costs, and supply continuity while reducing dependence on third-party suppliers.

Large domestic and multinational pharmaceutical firms are increasingly investing in captive API facilities to support vertical integration strategies. This trend aligns with broader efforts to localize production and enhance supply chain security, making captive manufacturing a key contributor to market growth.

Mexico Oncology Active Pharmaceutical Ingredients Market

The oncology API market in Mexico is expanding due to rising cancer incidence and increased access to diagnostic and treatment services. Demand for chemotherapy agents, targeted therapies, and biologics is driving the need for specialized APIs produced under stringent quality conditions.

Multinational partnerships and regulatory support for innovative cancer treatments are accelerating the introduction of new oncology drugs. As pharmaceutical companies expand their oncology portfolios, demand for high-value APIs in this therapeutic area is expected to grow steadily.

Mexico Orthopedic Active Pharmaceutical Ingredients Market

Orthopedic APIs are used in medications for musculoskeletal disorders such as arthritis, osteoporosis, and joint inflammation, conditions that are increasingly prevalent in Mexico’s aging population. Rising sedentary lifestyles and age-related health issues are contributing to sustained demand for pain management and bone health drugs.

Domestic pharmaceutical companies are expanding their orthopedic product lines, increasing demand for consistent and high-quality API supplies. Ongoing investment in formulation and therapeutic innovation further supports growth in this segment.

Mexico Nephrology Active Pharmaceutical Ingredients Market

The nephrology API segment is growing in response to increasing rates of kidney disease, largely driven by diabetes and hypertension. Chronic kidney disease places significant pressure on healthcare systems, increasing demand for pharmaceutical treatments that manage disease progression and associated complications.

APIs used in nephrology drugs, including antihypertensives and nephroprotective agents, are seeing rising demand from both public and private healthcare providers. Expansion of nephrology treatment services is expected to sustain growth in this specialized API segment.

Northern Mexico Active Pharmaceutical Ingredients Market

Northern Mexico, including states such as Nuevo León, Chihuahua, and Baja California, serves as a major hub for API manufacturing and pharmaceutical exports. Its proximity to the United States, strong industrial infrastructure, and skilled workforce attract significant investment from multinational companies.

Efficient logistics, favorable state-level policies, and access to cross-border trade routes make Northern Mexico a critical contributor to national API production and export growth.

Central Mexico Active Pharmaceutical Ingredients Market

Central Mexico, encompassing Mexico City, Jalisco, and Guanajuato, plays a pivotal role in API research, development, and production. The region hosts a concentration of pharmaceutical headquarters, research institutions, and regulatory bodies, supporting innovation and clinical development.

High population density, advanced infrastructure, and strong academic collaboration create a favorable environment for API manufacturing and technological advancement. Central Mexico continues to be a key driver of domestic demand and innovation in the API market.

Mexico Active Pharmaceutical Ingredients Market Segmentation

The Mexico API market is segmented by drug type into innovative and generic APIs. By synthesis, the market includes synthetic and biotech APIs. Based on manufacturer type, it is divided into captive and merchant producers.

By application, the market covers cardiovascular diseases, oncology, central nervous system and neurology, orthopedic, endocrinology, pulmonology, gastroenterology, nephrology, ophthalmology, and other therapeutic areas. Regionally, the market is analyzed across Northern Mexico, Central Mexico, Southern Mexico, and other regions.

Competitive Landscape and Key Players

The Mexico active pharmaceutical ingredients market is highly competitive, with global pharmaceutical companies and regional manufacturers actively expanding their presence. Companies are assessed across multiple dimensions, including company overview, leadership, recent developments, SWOT analysis, and revenue performance.

Key players operating in the market include Pfizer Inc., Novartis International AG, Sanofi, Boehringer Ingelheim, Bristol-Myers Squibb, Teva Pharmaceutical Industries Ltd., Eli Lilly and Company, GlaxoSmithKline, Merck & Co. Inc., and AbbVie Inc.. These companies continue to invest in capacity expansion, quality compliance, and strategic partnerships to strengthen their position in Mexico’s growing API market.