As European investment markets become more integrated, asset managers are increasingly launching and managing funds across multiple jurisdictions. Cross-border fund distribution allows access to a broader investor base, but it also introduces complex regulatory, reporting, and operational challenges. This is where fund administration services play a crucial role. They help investment firms manage operational complexity, maintain compliance, and ensure smooth fund operations across European markets such as Luxembourg, the Netherlands, and other EU jurisdictions.

The Complexity of Cross-Border European Fund Operations

European funds often operate under multiple regulatory frameworks while distributing products across different countries. Each jurisdiction may have specific requirements related to investor disclosures, tax reporting, and regulatory filings.

To manage this complexity, many investment firms rely on an experienced fund administrator to coordinate reporting timelines, maintain data accuracy, and support regulatory submissions across markets. This helps reduce compliance risk and operational delays.

Supporting Regulatory Compliance Across Jurisdictions

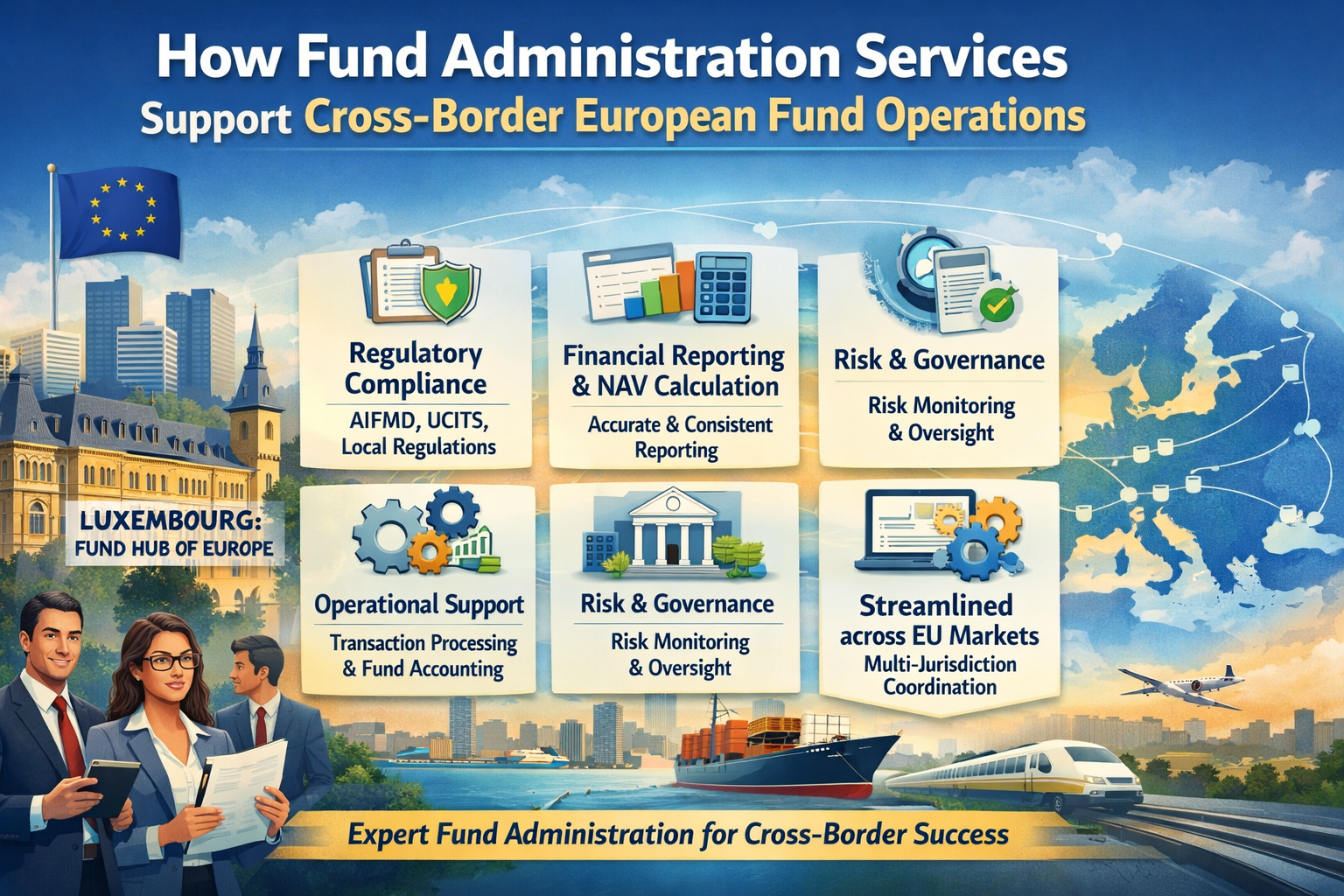

One of the most important roles of fund administration is supporting regulatory compliance. European investment funds must comply with frameworks such as AIFM, UCITS, and local regulatory reporting standards.

Professional administration support ensures reporting deadlines are met, financial data is validated, and required submissions are completed accurately. In major fund hubs like Luxembourg and the Netherlands, regulatory expectations are particularly strict, making specialised administration support essential.

Importance of Luxembourg in Cross-Border Fund Operations

Luxembourg continues to be a central hub for European investment funds. The country has built a strong reputation for regulatory quality, investor protection, and cross-border distribution expertise. Many global firms rely on structured fund administration Luxembourg expertise to manage reporting obligations and support multi-jurisdiction operations efficiently.

Luxembourg’s mature ecosystem of service providers, regulators, and financial infrastructure makes it easier for fund managers to operate across multiple EU markets.

Improving Financial and Investor Reporting Accuracy

Cross-border funds must provide consistent financial reporting and investor communication across multiple markets. Leading fund administration companies help standardise reporting frameworks, ensuring consistent and accurate financial data delivery.

This includes NAV calculation support, investor reporting, performance reporting, and financial statement preparation. Accurate reporting improves investor confidence and strengthens relationships with global investors.

Streamlining Operational Processes Across Multiple Markets

Professional administration support helps streamline transaction processing, reconciliation, and financial data management. For cross-border funds, this ensures consistency across multiple fund structures and jurisdictions.

Many asset managers prefer working with top fund administrators who can provide integrated operational support across reporting, compliance, and investor servicing.

Supporting Risk Management and Governance

Risk monitoring is critical for cross-border European funds. High-quality financial data helps support liquidity monitoring, leverage tracking, and risk exposure analysis.

Selecting the best fund administrator can significantly improve governance structures by ensuring accurate reporting, strong internal controls, and reliable financial data oversight.

Enabling Faster Fund Launch and Expansion

Fund administration support also helps new fund launches and cross-border expansion. Administration providers help establish reporting frameworks, operational processes, and compliance structures required for multi-jurisdiction operations.

Many global asset managers partner with experienced service providers to manage operational complexity and scale fund operations efficiently across European markets.

The Role of Technology in Modern Fund Operations

Modern administration providers use advanced technology to manage data processing, reporting automation, and investor communication. Technology helps standardise reporting across jurisdictions and improves operational transparency.

Automation reduces manual errors and helps investment firms respond faster to regulatory and investor reporting requirements.

Conclusion

Cross-border European fund operations require strong regulatory understanding, accurate reporting, and efficient operational management. Professional fund administration support provides the infrastructure and expertise required to manage these complexities successfully.

As investment firms continue expanding across European markets, demand for specialised administration expertise will continue to grow. Firms that invest in strong operational partnerships will be better positioned to maintain compliance, support investor confidence, and scale fund operations efficiently across Europe.