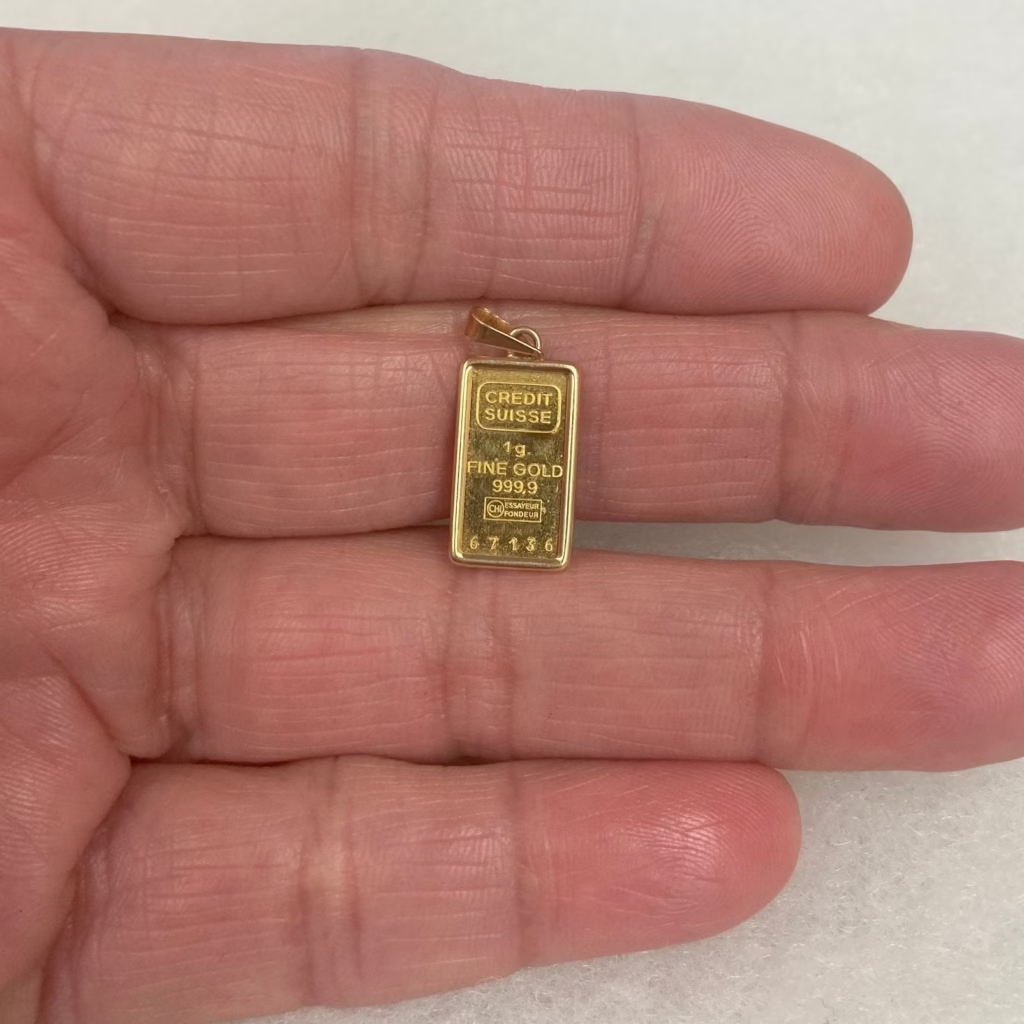

Gold has remained a stable investment for centuries, offering security against market uncertainty. Products like the Credit Suisse 1g gold bar provide a tangible asset that preserves value over time. Unlike stocks or bonds, physical gold carries no default risk and is universally recognized for its intrinsic worth. Investors appreciate its liquidity and historical performance as a hedge against economic fluctuations. Owning gold bars delivers peace of mind while helping diversify a financial portfolio, making it a preferred choice for those aiming for long-term wealth protection and stability in uncertain markets.

Stability in Value

Gold bars consistently maintain value even during economic turbulence. While traditional investments, such as equities or corporate bonds, can experience sudden drops, physical gold’s intrinsic worth remains recognized globally. Financial crises often boost demand for gold, reinforcing its reputation as a secure asset. This stability makes it a reliable component in long-term financial planning. Investors can depend on gold bars to preserve purchasing power, ensuring wealth protection across varying market conditions. Its historical performance proves resilience against inflation, currency fluctuations, and geopolitical risks, solidifying its position as a trusted investment.

Tangible Asset

Physical gold bars provide direct ownership, unlike paper-based or digital investments. Holding gold offers investors a sense of security and control, allowing them to store, transport, or sell their assets at will. Certified bars guarantee purity and weight, ensuring transparent value. This tangibility is critical for those seeking reliable investments independent of external institutions. Investors often find reassurance in the visible and verifiable nature of gold, which cannot be replicated by stocks or cryptocurrencies. The physical aspect adds credibility, making gold a highly respected asset for personal wealth preservation and estate planning strategies.

Liquidity and Accessibility

Gold bars are highly liquid, making them easy to convert into cash anywhere in the world. Banks, bullion dealers, and private buyers accept widely recognized brands, such as Credit Suisse or PAMP, facilitating smooth transactions. Smaller denominations, including 1g and 10g bars, allow new investors to start small, while experienced investors can acquire larger quantities for significant portfolio diversification. The combination of liquidity and accessibility ensures investors can respond promptly to financial needs or market opportunities. This flexibility, coupled with global acceptance, reinforces gold bars as an efficient and practical investment solution for all levels of investors.

Hedge Against Inflation

Gold serves as an effective hedge against rising prices and currency devaluation. When fiat currencies lose purchasing power, gold retains its intrinsic value, helping protect investors’ wealth. Over decades, gold has historically outperformed during periods of inflation, demonstrating its reliability as a long-term financial safeguard. Including gold bars in a diversified investment strategy reduces exposure to currency risk and ensures stability in purchasing power. Investors recognize that physical gold is one of the few assets capable of preserving value during economic volatility, making it a strategic choice for both short-term protection and long-term wealth retention.

Global Recognition

Gold enjoys universal recognition as a valuable asset. Bars produced by reputable mints and refineries guarantee purity and authenticity, gaining trust across international markets. Well-known brands such as Credit Suisse and PAMP are accepted worldwide, ensuring smooth resale or trade anywhere. Global acknowledgment adds significant practicality, as investors can liquidate assets without local restrictions or currency concerns. This widespread acceptance reinforces confidence in gold bars as a long-term investment. Investors benefit from both financial security and ease of transaction, knowing their holdings carry intrinsic value recognized by institutions, collectors, and governments globally.

Low Counterparty Risk

Owning physical gold bars eliminates dependence on banks, corporations, or government guarantees. Unlike stocks or bonds, which rely on company performance or regulatory assurances, gold maintains its value independently. This low counterparty risk makes gold a dependable asset during financial uncertainty. Investors seeking to reduce exposure to defaults or systemic crises often allocate a portion of their portfolio to physical gold. The asset’s independence ensures that its value remains stable regardless of market instability, providing a reliable safeguard for wealth preservation and peace of mind for those prioritizing risk mitigation in their long-term investment strategy.

Portfolio Diversification

Gold bars enhance portfolio resilience by reducing overall risk. Benefits of including gold in an investment mix include:

- Minimizing volatility from stock and bond fluctuations

- Protecting against currency depreciation

- Preserving purchasing power during economic downturns

- Providing an asset that often moves independently of traditional markets

Diversification with gold bars allows investors to create a balanced portfolio that can withstand market uncertainty. This strategic allocation improves long-term stability, reducing the impact of unexpected losses and enabling investors to achieve both growth and security across varying financial conditions.

Security and Certification

Certified gold bars provide guarantees of purity and weight, ensuring credibility and resale value. Authentication establishes trust for buyers and sellers alike, creating transparency often absent in other investments. Proper storage, whether in high-quality safes or bank vaults, further protects the asset from theft or damage. This combination of certification and security reinforces the investment’s reliability. Investors gain confidence knowing that their holdings are tangible, verifiable, and safeguarded, making gold bars a preferred choice for maintaining long-term wealth while minimizing risks associated with fraud or misrepresentation.

Conclusion

Gold bars combine stability, liquidity, and tangible ownership to offer a reliable investment solution. They protect against inflation, reduce portfolio risk, and carry universal recognition. Trusted products like the Credit Suisse 1g gold bar provide assurance in both security and resale potential. For investors focused on long-term financial stability, integrating physical gold into a diversified strategy offers consistent protection and wealth preservation. Gold bars remain a prudent choice for anyone seeking a secure, tangible asset capable of safeguarding value across generations.

FAQs

1. Are gold bars a safe investment for beginners?

Yes. Small denominations allow beginners to start with minimal risk while gaining exposure to gold’s stability and liquidity.

2. How do gold bars protect against inflation?

Gold retains intrinsic value as currencies fluctuate, providing a reliable hedge and preserving purchasing power over time.

3. Can gold bars be sold easily worldwide?

Certified bars from reputable brands are recognized globally, enabling smooth resale or trade in most international markets.

4. Why is certification important for gold bars?

Certification ensures purity and weight, creating transparency and guaranteeing credibility for resale or investment verification.

5. How does gold improve portfolio diversification?

Gold often moves independently of stocks and bonds, reducing overall volatility and enhancing long-term portfolio stability.