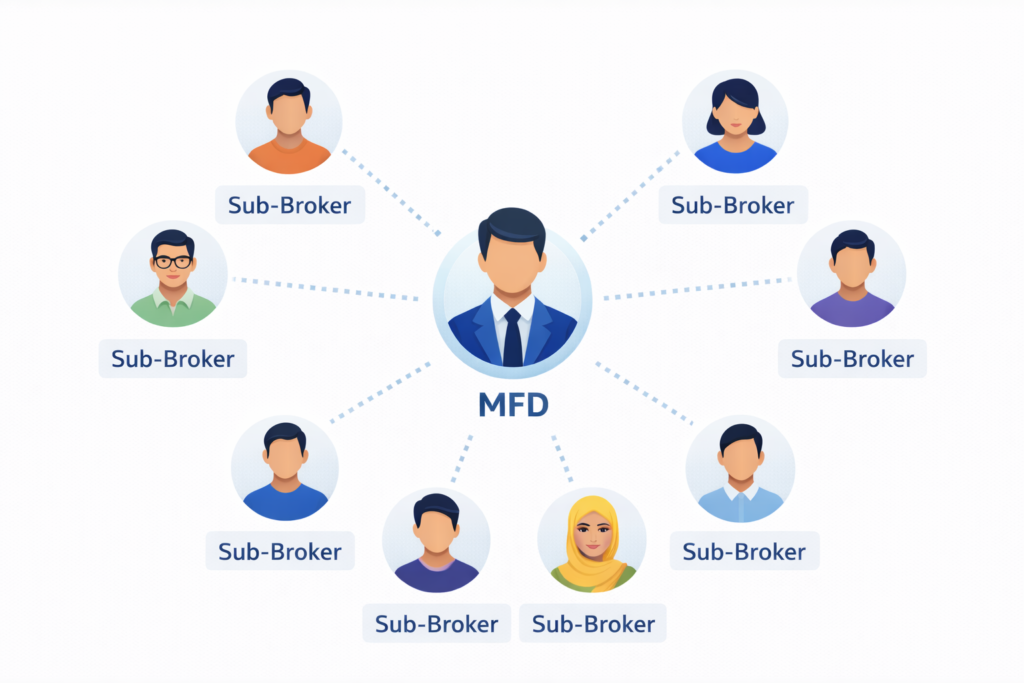

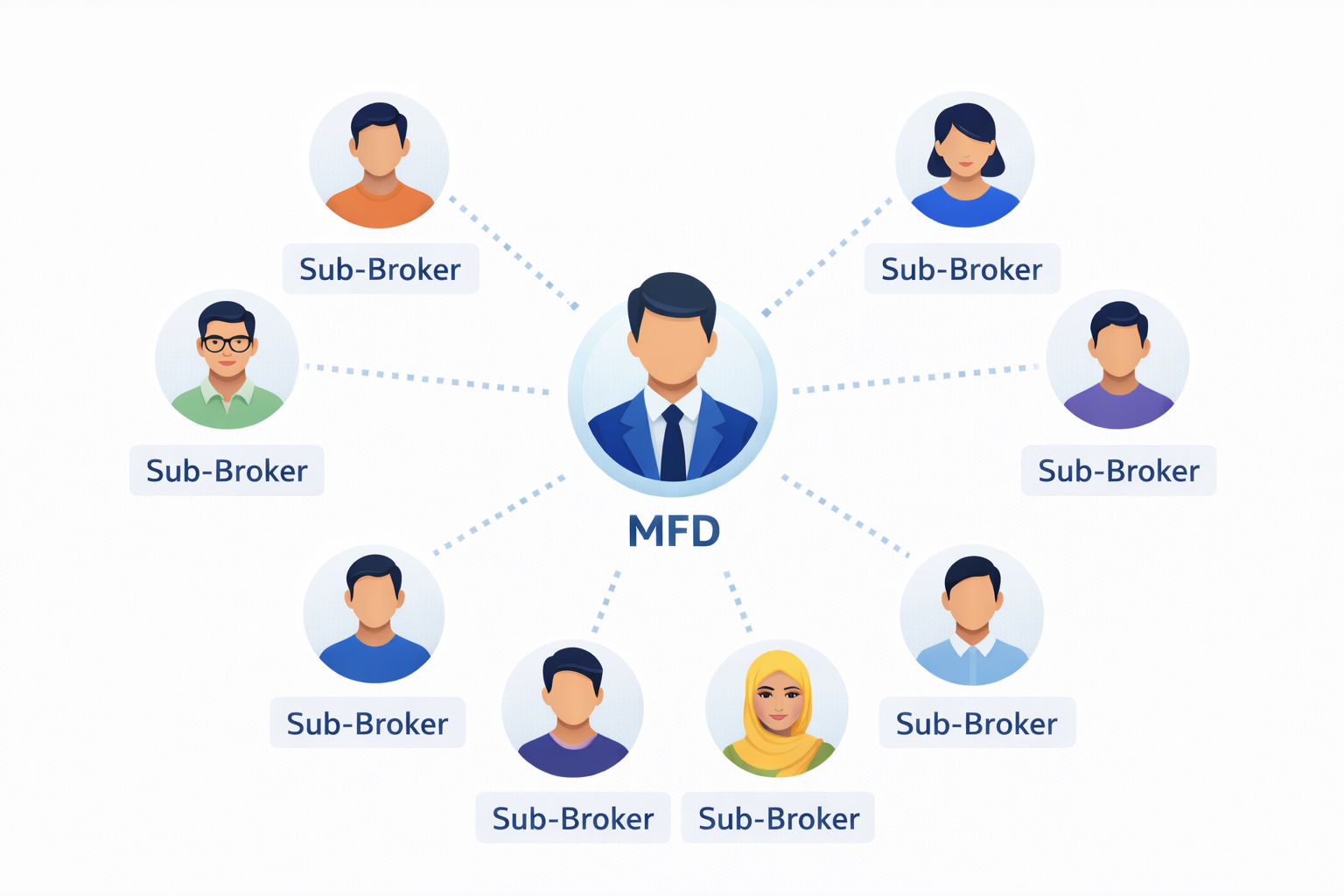

MFDs who operate with sub-brokers, relationship managers (RMs), branches, or corporate hierarchies, software-based management is no longer optional for them, and modern mutual fund software for distributors in India does support structured sub-broker management.

If you are scaling beyond an individual practice, you need a system that can handle hierarchy, access control, payout clarity, and performance tracking — all in one place.

Let’s break this down clearly.

Why Sub-Broker Management Matters for Growing MFDs

Many distributors start solo. But as business grows, expansion often happens through:

● Sub-brokers

● Relationship Managers (RMs)

● Branch desks

● Corporate-level structures

Without a proper system, managing:

● client mapping

● commission splits

● payout records

● performance contribution

● access control

becomes messy very quickly.

Manual tracking leads to disputes, confusion, and delayed payouts — which can damage internal trust.

That’s where structured Best Mutual Fund Software for Distributors in India like Wealth Elite makes a difference.

How Best Mutual Fund Software for Distributors in India Supports Sub-Broker Management

1. Clear Hierarchy Structure

Modern platforms allow you to create structured levels such as:

● Corporate Desk

● RM Level Desk

● Branch Desk

● Sub-Broker Desk

Each level can be clearly defined within the system. This helps:

● Maintain reporting lines

● Assign responsibility

● Monitor business performance

● Avoid overlapping access

Instead of scattered control, everything flows through a defined hierarchy.

2. Sub-Broker Mapping & Client Visibility

Software allows:

● Mapping specific clients under specific sub-brokers

● Viewing which sub-broker manages which investors

● Filtering business data sub-broker-wise

This prevents confusion about ownership and servicing responsibility.

When data is structured, accountability improves.

3. Controlled Data Access

One major concern MFDs have is: “Will sub-brokers see all my clients?”

Good wealth management software allows:

● Restricted client visibility

● Role-based access

● Controlled report access

● Defined editing permissions

This ensures business security while still empowering sub-brokers to operate independently.

4. Brokerage Split & Payout Management

Sub-broker relationships often involve commission sharing.

Software simplifies:

● Rate card creation

● Category-based brokerage splits

● Month-wise payout calculations

● Net brokerage visibility

● Exportable payout reports

Instead of manually calculating percentages every month, the system automates calculations based on predefined rules.

This reduces disputes and saves time.

5. RM Level Desk for Mid-Tier Management

For larger setups, an RM Level Desk acts as a bridge between:

● Corporate-level control

● Branch desks

● Sub-brokers

RMs can:

● Manage assigned sub-brokers

● Track client performance

● Monitor business metrics

● Support onboarding and servicing

This layered structure makes expansion manageable without losing oversight.

6. Corporate Desk for Centralised Control

For firms operating at scale, a Corporate Desk allows:

● Consolidated business visibility

● Multi-branch monitoring

● Unified reporting

● Centralised analytics

● Better strategic planning

It brings together data from all sub-level desks into one comprehensive view.

Why This Is Critical for Scaling MFD Businesses

Without structured software:

● Payout disputes increase

● Client ownership confusion arises

● Performance tracking becomes difficult

● Compliance risks grow

● Operational workload multiplies

With structured sub-broker management:

● Revenue becomes transparent

● Teams stay aligned

● Growth becomes scalable

● Control remains centralized

This transforms distribution from an individual-driven practice into a professionally managed business.

How Sub-Broker Management Impacts Revenue Stability

Managing sub-brokers is very different from managing your own individual business. When you work alone, you directly control clients, transactions, and income. But once sub-brokers are involved, revenue starts flowing through multiple contributors — and without structure, visibility becomes unclear.

If sub-broker contributions are not tracked properly, revenue forecasting becomes guesswork. You may know your total AUM, but not clearly know which sub-broker is driving growth, which ones are inactive, or which relationships are truly profitable after payouts. Manual calculations can also lead to payout mismatches or delays, which can demotivate productive partners.

Structured sub-broker management through software brings clarity. It ensures proper client mapping, transparent brokerage splits, and accurate payout tracking. When contributions and earnings are visible, trust improves — and stable, predictable revenue becomes easier to maintain.

Is Sub-Broker Management Necessary for Every MFD?

Not necessarily.

If you operate alone with a small client base, advanced hierarchy features may not be immediately required.

However, if you:

● Plan to expand

● Work with multiple sub-brokers

● Manage branches

● Handle large AUM

● Want structured income tracking

then sub-broker management capability inside your mutual fund software becomes extremely valuable.

Final Thoughts

So, does mutual fund software for distributors in India support sub-broker management? Yes — and the best platforms go beyond simple client tracking. They provide hierarchical desk structures, role-based access control, brokerage split management, RM and corporate-level visibility, and automated payout processes

For MFDs who aim to build long-term, scalable advisory businesses, structured sub-broker management is not just a feature — it’s a foundation.

FAQs

1. Can mutual fund software manage multiple sub-brokers under one ARN?

Yes. Advanced platforms allow mapping multiple sub-brokers, assigning clients, and managing brokerage splits within a single structured system.

2. Can I track sub-broker performance separately in mutual fund software?

Yes. Modern mutual fund software allows you to track sub-broker performance independently by mapping clients under specific sub-brokers and viewing their contribution separately.

3. Can I control what sub-brokers can see in the system?

Yes. Most modern software offers role-based access control, allowing you to restrict client data, reports, and transaction visibility.

4. Does sub-broker management help reduce payout disputes?

Yes. Automated brokerage calculation and payout tracking reduce manual errors and improve transparency, minimizing disputes.