Cash flow is everything in the maritime industry. You can pay crews, maintain equipment, meet loan payments, and respond to market fluctuations. You can only do so with predictable and consistent finances, whether you run a single ship or a global shipping fleet. That balance can be disturbed overnight through a single unexpected incident at sea. Marine liabilities insurance is essential there.

The dangers involved in marine activities are far more than the normal business exposure. Collision, pollution incidents, cargo damage, crew injury and third-party claims can all result in huge financial losses. These expenses can be a direct draw on operating capital without the benefit of appropriate coverage, which can impose direct pressure on cash flow. Marine liabilities insurance is a financial cushion that protects businesses against unforeseen, expensive occurrences that may otherwise cause them to collapse.

Knowledge of Marine Liabilities Insurance

Marine liabilities insurance is created to cater to legal and financial obligations arising during maritime activities. Liability coverage is the opposite of hull or cargo insurance, which concentrates on physical property. These assertions may refer to personal injury, property damage, environmental damage, or even contracts.

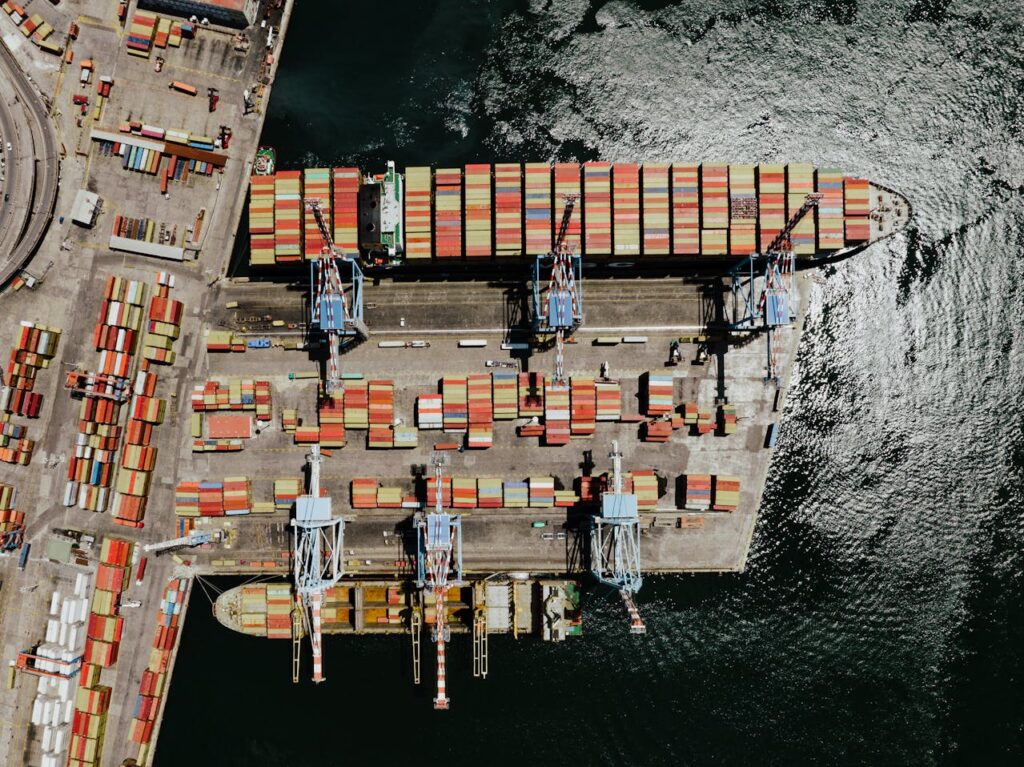

These liabilities are not hypothetical to shipowners, charterers, terminal operators, and marine service providers. They form part of the normal operations in busy ports, narrow waterways, and international trade routes. By having marine liabilities insurance, the financial responsibility of claims is not transferred solely to the working capital of the company.

The Direct Effect of Marine Claims on Cash Flow

Marine accidents are unpredictable and costly. One accident can result in several claims simultaneously. Defence money, settlements, clean-up, and regulatory fines can build up fast. Legal proceedings alone can drain cash reserves even though a business may be eventually acquitted.

When marine liabilities insurance is not in place, these costs must be paid by the companies. This may result in late payroll, deferred maintenance, poor relations with lenders, or even forced sales of assets. In the worst-case scenario, firms might be forced to close down altogether until the conflict is sorted out.

In comparison, marine liabilities insurance tends to absorb a great deal of this financial shock. By being insured, businesses can retain cash to fund core operations because insurers cover defence costs and claims. This stability is particularly relevant in an industry where the margins may be lean and time is of the essence.

Hedging against Widespread, Unforeseen Losses

Exposure to disastrous losses is one of the most worthwhile means that marine liabilities insurance protects cash flow. Cases such as environmental pollution claims can go into millions of dollars. Clean-up, government fines, and damages by third parties mount quickly.

Even a company that is financially healthy may not be able to absorb such losses without insurance. Marine liabilities insurance also assures these expenses are shifted onto the insurer, so that an individual incident does not eliminate years of profits or cause emergency financing at poor terms.

This coverage enables marine enterprises to plan effectively. Companies will be able to invest capital in growth, fleet upgrades, and operational improvements rather than stash excess cash in the event of worst-case situations.

Normalising Current Operating Costs

Major disasters are not the only things that lead to cash flow problems. Minor accidents can result in permanent financial stress. Medical expenses, compensation, and legal fees can be relevant in the long term in relation to crew injury claims, dock damage, or cargo handling disputes.

Marine liabilities insurance eases these costs by assisting in covering the required expenses as they occur. This eliminates unexpected increases in expenditure that destabilise monthly budgets. A steady cash flow simplifies payment of staff, fuel, port charges, and maintenance plans without interruption.

This consistency is even more beneficial in cases of businesses operating in various jurisdictions. Laws, time limits of claims, and settlement policies are different. Marine liabilities insurance offers an orderly, dependable method to handle such uncertainties.

Access to Financing and Contracts

Good cash flow safeguard also enhances the credibility of firms among lenders and business associates. When banks, investors, and charterers are entering into agreements, they often need to be assured of marine liabilities insurance. They realise that the risk of default is heightened by the uninsured liability exposure.

Companies exhibit discipline and financial responsibility by ensuring that they have sufficient marine liabilities insurance. This may result in improved terms of loans, easier credit access, and more favourable contract conditions. Subsequently, the better funding opportunities contribute to long-term cash flow stability.

Numerous ports, terminals, and clients will not collaborate with operators that are underinsured. Insurance is not only a defensive tool. It is a facilitator of business continuity and revenue generation.

Minimising Legal and Administrative Burdens

Handling claims in-house can eat up a lot of time and resources. Disputes can distract legal teams, administrative staff and senior management as they are forced to take time out of day-to-day activities. This is an unseen expense that influences productivity and indirectly touches on cash flow.

Access to qualified claims handlers and maritime law experts is generally included in marine liabilities insurance. Insurers handle negotiations, paperwork, and litigation. This minimises internal interference and enables companies to concentrate on the effective operation of their businesses.

Financial planning can be more precise and sustainable when leadership can focus on strategy, as opposed to crisis management.

Risk Management and Long-Term Cash Flow Planning

Cash flow protection is not only about the survival of single events. It is long-term resilience. Marine liabilities insurance enhances strategic planning by minimising financial uncertainty. Companies are able to predict costs more precisely and prevent reactive decision-making caused by unexpected losses.

This stability in the long run enables firms to develop a stronger balance sheet, retain a healthier cash balance, and invest with confidence in growth. Insurance payments will be a foreseeable operating expense and not an unforeseeable emergency payment.

Predictability is a competitive edge in an industry defined by weather, regulations and global trade changes.

The Importance of Marine Liabilities Insurance

Whether it is the payment of legal defence expenses or absorbing devastating losses, marine liabilities insurance makes sure that a single event does not determine the financial destiny of a company. It is an important investment in continuity, credibility, and cash flow protection for any organisation operating on or around the water.

The presence of marine liability insurance is not an option in the complex world of maritime commerce. It is indispensable to maintaining the processes in motion and funding stability regardless of the difficulties at sea.