North America Gas Chromatography Market Size and Forecast

The North America Gas Chromatography Market is projected to grow from US$ 1.6 billion in 2024 to US$ 2.64 billion by 2033, expanding at a CAGR of 5.75% from 2025 to 2033. Market growth is primarily driven by stricter environmental and food safety regulations, increasing pharmaceutical and biotechnology research, and rising demand for analytical testing in petrochemical, environmental, and forensic applications. The growing adoption of advanced GC systems, consumables, and laboratory modernization initiatives further strengthens regional expansion.

Download Free Sample Report:

https://www.renub.com/request-sample-page.php?gturl=north-america-gas-chromatography-market-p.php

North America Gas Chromatography Industry Overview

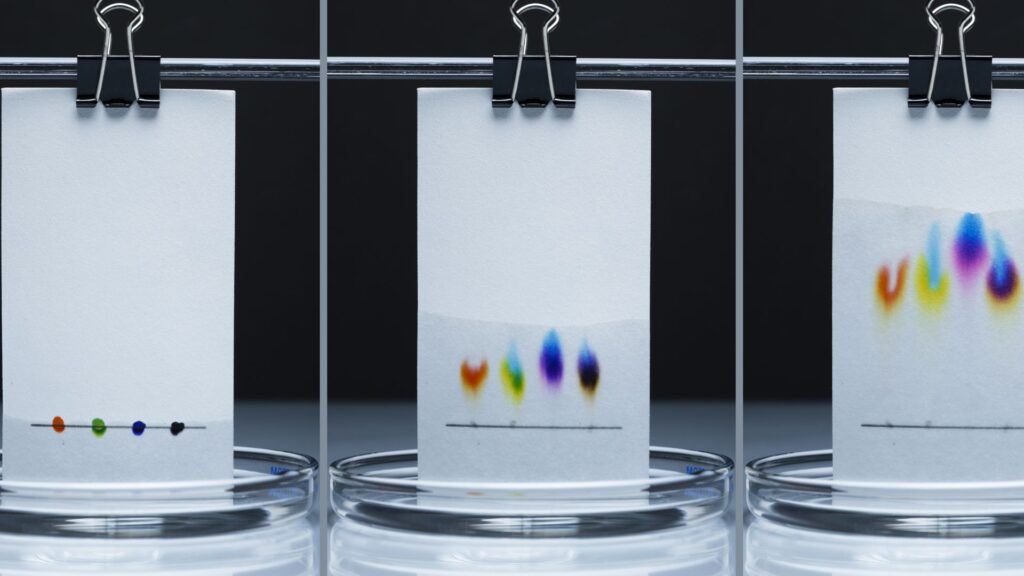

Gas chromatography (GC) is an analytical technique used to separate and analyze compounds that can vaporize without decomposition. It employs an inert carrier gas (mobile phase) and a stationary phase within a coated column to separate mixtures based on volatility and interaction with column materials.

GC plays a critical role in pharmaceutical development, environmental monitoring, petrochemical analysis, food and beverage quality control, and forensic investigations. The technique delivers highly accurate qualitative and quantitative data, including trace-level detection. Its sensitivity, reproducibility, and reliability make it essential for regulatory compliance, research innovation, and industrial quality assurance.

Across North America, regulatory bodies overseeing food safety, water quality, air emissions, and pharmaceutical purity standards require robust analytical testing. This regulatory environment significantly increases demand for GC systems and GC-MS (gas chromatography–mass spectrometry) platforms.

The region benefits from a strong presence of global analytical instrument manufacturers, advanced laboratory infrastructure, and high R&D expenditure, particularly in the United States and Canada.

Growth Drivers for the North America Gas Chromatography Market

Expansion of Pharmaceutical, Biotechnology, and Food-Safety Applications

North America hosts a highly developed pharmaceutical and biotechnology ecosystem. GC is extensively used for residual solvent analysis, impurity profiling, metabolite separation, and chemical fingerprinting in drug development and quality control.

As drug pipelines grow more complex, laboratories increasingly rely on advanced GC and GC-MS systems to meet stringent regulatory standards. Simultaneously, consumer awareness of food contamination and agricultural safety drives demand for contaminant testing using GC instruments.

The convergence of pharmaceutical, biotech, and food safety applications substantially increases instrument adoption and consumables usage across the region.

Technological Innovation, Automation, and Integrated GC Solutions

Technological advancements are reshaping the GC landscape. Modern systems offer enhanced sensitivity, faster run times, automatic diagnostics, remote monitoring, and integration with Laboratory Information Management Systems (LIMS).

Cloud connectivity, predictive maintenance capabilities, and hybrid GC-MS configurations expand analytical capacity while improving operational efficiency. Automation reduces downtime and enhances throughput, which is essential for laboratories processing large sample volumes.

As laboratories modernize and transition toward smart analytical infrastructures, demand for next-generation GC platforms continues to rise.

Environmental Sustainability and Regulatory Compliance

Environmental monitoring is a major growth driver. The U.S. and Canada enforce strict regulations governing emissions, water safety, and chemical waste management. GC systems are widely used to monitor volatile organic compounds (VOCs), greenhouse gases, and environmental pollutants.

Government initiatives promoting green chemistry and sustainable industrial processes encourage upgrades to more precise and automated GC technologies. As sustainability becomes central to industrial policy, analytical infrastructure investments continue to accelerate.

Challenges in the North America Gas Chromatography Market

High Cost and Operational Complexity

Advanced GC systems, particularly GC-MS platforms designed for ultra-low detection limits, require significant capital investment. Ongoing costs related to consumables, carrier gases (helium or hydrogen), calibration, and maintenance add to operational expenses.

Smaller laboratories may face financial constraints, delaying upgrades or limiting expansion capacity. Additionally, skilled chromatographers are required to manage complex systems, increasing labor costs.

Regulatory and Analytical Complexity

Testing requirements continue to evolve, particularly in areas such as PFAS detection, microplastics analysis, and ultra-trace impurity profiling. Laboratories must handle multi-matrix sample preparation and rigorous method validation procedures.

Regulatory harmonization between U.S. and Canadian standards remains complex, adding compliance challenges for laboratories operating across borders. These complexities increase both costs and time-to-implementation for new GC technologies.

United States Gas Chromatography Market

The United States represents the largest share of the North American GC market. Extensive pharmaceutical, biotechnology, petrochemical, environmental monitoring, and forensic infrastructures drive demand.

Strict regulatory oversight mandates high-quality testing standards, ensuring sustained GC system adoption. The U.S. leads in drug discovery, metabolomics research, and industrial process monitoring, requiring advanced GC-MS instrumentation.

However, high system costs, workforce skill requirements, and continuous technological upgrades present ongoing challenges.

Canada Gas Chromatography Market

Canada’s GC market benefits from strong academic institutions, government-funded laboratories, and demand across energy, environmental, and biotechnology sectors.

Environmental monitoring—particularly air, soil, and water analysis—remains a significant application area. While smaller in overall size compared to the U.S., Canada often demonstrates higher relative growth rates due to modernization initiatives and increased analytical budgets.

Regional regulatory requirements and bilingual compliance standards require flexible and sophisticated GC systems.

Recent Developments in the North America Gas Chromatography Market

- August 2025: Agilent Technologies introduced the Agilent J&W 5Q GC/MS Columns, offering ultra-inert and low-bleed performance for trace-level analytical applications.

- June 2025: Agilent launched the 7010D Triple Quadrupole GC/MS System, featuring enhanced sensitivity and compliance-ready data management tools.

- April 2025: Thermo Fisher Scientific announced a US$ 2 billion investment to expand U.S. manufacturing and R&D operations, including advancements in life-science instrumentation and GC technologies.

- March 2025: Cytiva and Pall Corporation pledged US$ 1.5 billion to expand chromatography resin production across multiple facilities in the U.S. and UK.

- March 2022: Thermo Fisher Scientific introduced next-generation GC and GC-MS instruments with improved automation and simplified user interfaces.

North America Gas Chromatography Market Segmentation

By Instrument Type

- Systems

- Detectors

- Auto-samplers

- Fraction Collectors

- Micro & Portable GC

- Other Instruments

Accessories & Consumables

- Columns

- Column Accessories

- Pressure Regulators

- Gas Generators

- Fittings & Tubing

- Others

By Detector Type

- Flame Ionization Detector (FID)

- Thermal Conductivity Detector (TCD)

- Electron Capture Detector (ECD)

- Mass Spectrometry Detector (GC-MS)

- Others

By End User

- Pharmaceutical & Biotechnology Companies

- Oil & Gas / Petrochemical Industry

- Environmental & Waste-water Agencies

- Food & Beverage Industry

- Academic & Government Research Institutes

- Others

Geographic Coverage

United States

- California

- Texas

- New York

- Florida

- Illinois

- Pennsylvania

- Ohio

- Georgia

- New Jersey

- Washington

Canada

- Alberta

- British Columbia

- Manitoba

- New Brunswick

Key Players Analysis

The report evaluates companies from five perspectives: Company Overview, Key Persons, Recent Developments & Strategies, SWOT Analysis, and Sales Analysis.

Leading companies include:

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Chromatotec

- Merck KGaA

- PerkinElmer Inc.

- Phenomenex Inc. (Danaher Corporation)

- Restek Corporation

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- Waters Corporation

Final Thoughts

The North America gas chromatography market is poised for steady growth through 2033, driven by regulatory compliance requirements, pharmaceutical innovation, environmental monitoring priorities, and technological modernization.

As laboratories upgrade infrastructure and industries pursue sustainability goals, demand for advanced GC systems, consumables, and integrated analytical platforms will continue to expand.

With projected revenues reaching US$ 2.64 billion by 2033, gas chromatography will remain a cornerstone analytical technology across pharmaceuticals, environmental science, petrochemicals, and food safety industries in North America.