Why Renko Charts Appeal to Serious Traders

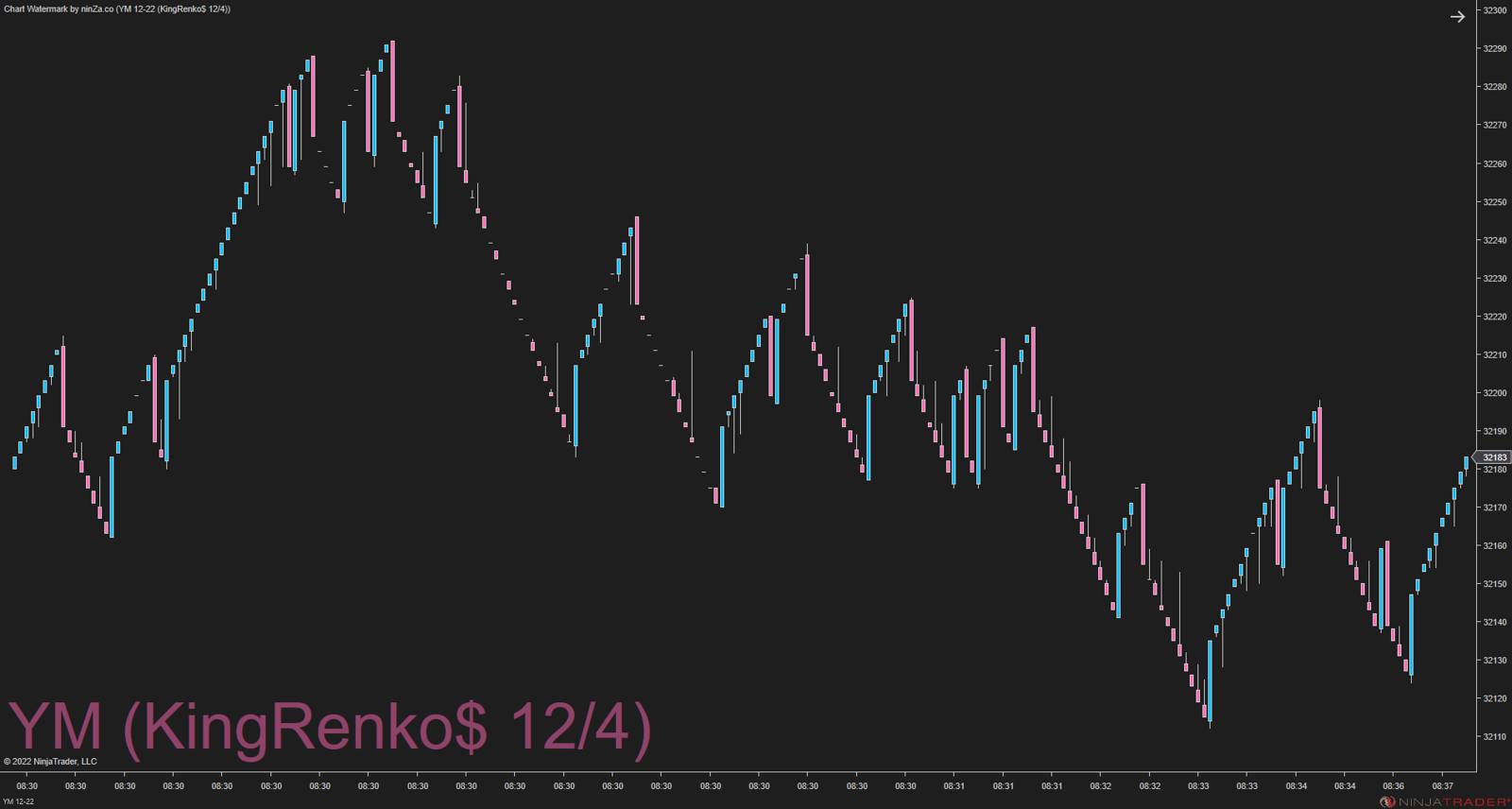

Renko charts do not care about time. They only care about price. A new brick forms only when price moves a defined amount. This simple rule filters out small fluctuations that often mislead traders. What remains is a cleaner view of the market.

For day traders, this means fewer false signals. For trend followers, it means trends appear more clearly and last longer on the chart. Trades feel calmer because the chart itself feels calmer.

The Importance of Rule-Based Trading

Rules remove emotion. That is the core benefit of a rule-based approach. Every trade has a reason. Every exit has a condition. Nothing is left to impulse.

A solid Renko Trading Strategy often starts with trend confirmation. Traders wait for prices to move in one clear direction before entering. This patience protects capital and improves consistency over time.

Using Indicators Without Overloading the Chart

Renko charts are best done with simple, effective tools. The use of trend indicators is usually desired since it coincides with the design of the Renko bricks. A clean trend line or confirmation signal helps the traders to keep track of the market direction.

Many traders using NinjaTrader rely on a trusted Ninjatrader Trend Indicator to confirm entries and exits. Once the indicator is in the same direction as the Renko brick, it forms a high-quality signal. In the event that it does not, traders stay away. This in itself spares several failing trades.

Platform Matters More Than Most Traders Think

Execution speed, chart flexibility, and indicator support all matter. NinjaTrader remains popular among Renko traders because it handles non-time-based charts smoothly.

Custom and built-in Ninjatrader 8 Indicators allow traders to refine their strategy without overcomplicating it. The key is restraint. One or two strong indicators often outperform a cluttered chart.

Experienced traders also test their rules extensively. They observe how the Ninjatrader Trend Indicator behaves in strong trends, ranges, and reversals. This understanding builds trust in the system.

Discipline Turns Strategy Into Results

A strategy alone does nothing. Discipline is what turns rules into results. Traders who follow their plan trade less, but trade better. Losses become controlled. Wins feel earned, not lucky.

When Renko rules are followed consistently, trading becomes a process, not a reaction.

Conclusion

Renko Trading Strategy is a reward of patience, organization and simplicity. It is appropriate among traders who prefer clarity. Renko charts have the potential to revolutionize the perception and trade of the market with the correct rules and the correct tools.

For traders looking to deepen their understanding of Renko-based systems and practical information around Ninjatrader 8 Indicators, resources from RenkoKings can be a helpful place to explore proven concepts and structured learning without hype.