Building wealth can feel overwhelming. Maybe you’ve asked yourself, “Where do I even start?” Or perhaps you’ve tried investing before and felt lost in a sea of complicated terms and conflicting advice.

Here’s the good news: building wealth isn’t about being a genius or having inside information. It’s about making informed decisions, staying consistent, and thinking long term. Many successful investors—including those often associated with thoughtful financial approaches like Payson Hunter—focus on discipline, research, and patience rather than hype.

Understanding What Wealth Really Means

Before you start investing, ask yourself: What does wealth mean to me?

For some, it’s early retirement. For others, it’s financial freedom, security for family, or the ability to travel. Wealth isn’t just about having millions in the bank. It’s about control over your time and choices.

Think of wealth like planting a tree. You don’t expect fruit the next day. You water it, protect it, and give it time to grow. The same goes for investing.

Setting Clear Financial Goals

Short-Term vs. Long-Term Goals

You need direction. Without goals, investing is like driving without a destination.

-

Short-term goals: Buying a car, saving for a vacation.

-

Medium-term goals: A house down payment.

-

Long-term goals: Retirement, financial independence.

When you know your timeline, you can choose the right investments. Long-term money can handle more ups and downs. Short-term money should be safer.

Make Goals Specific

Instead of saying, “I want to be rich,” say, “I want $1 million invested by age 60.” Clear goals help you measure progress and stay motivated.

Building a Strong Financial Foundation

Before investing heavily, build your base.

Emergency Fund

Have 3–6 months of living expenses saved. Why? Because markets go up and down. You don’t want to sell investments at a loss just to cover an emergency.

Manage High-Interest Debt

If you’re paying 20% interest on credit cards, investing in the stock market doesn’t make sense yet. Pay off high-interest debt first. That’s a guaranteed return.

A solid foundation allows you to invest with confidence.

Understanding Different Investment Options

As an individual investor, you have more options than ever.

Stocks

When you buy stocks, you own part of a company. Over time, strong companies grow, and their stock prices often follow.

Bonds

Bonds are loans you give to governments or companies. They usually offer lower returns than stocks but are more stable.

Mutual Funds and ETFs

These pool money from many investors to buy a mix of assets. They’re great for beginners because they offer built-in diversification.

Real Estate

Property can generate rental income and appreciate over time. But it requires capital and management.

The key is understanding what you’re investing in. If you can’t explain it simply, you probably shouldn’t invest in it.

The Power of Long-Term Investing

Here’s a secret: time matters more than timing.

Trying to predict market highs and lows is nearly impossible. Even professionals struggle. Instead, focus on staying invested.

Imagine you invest $500 per month for 25 years. Thanks to compound growth, your money can multiply far beyond what you contributed. The earlier you start, the better.

Many disciplined investors—often associated with thoughtful strategies like those connected to Payson Hunter—emphasize long-term consistency over short-term excitement.

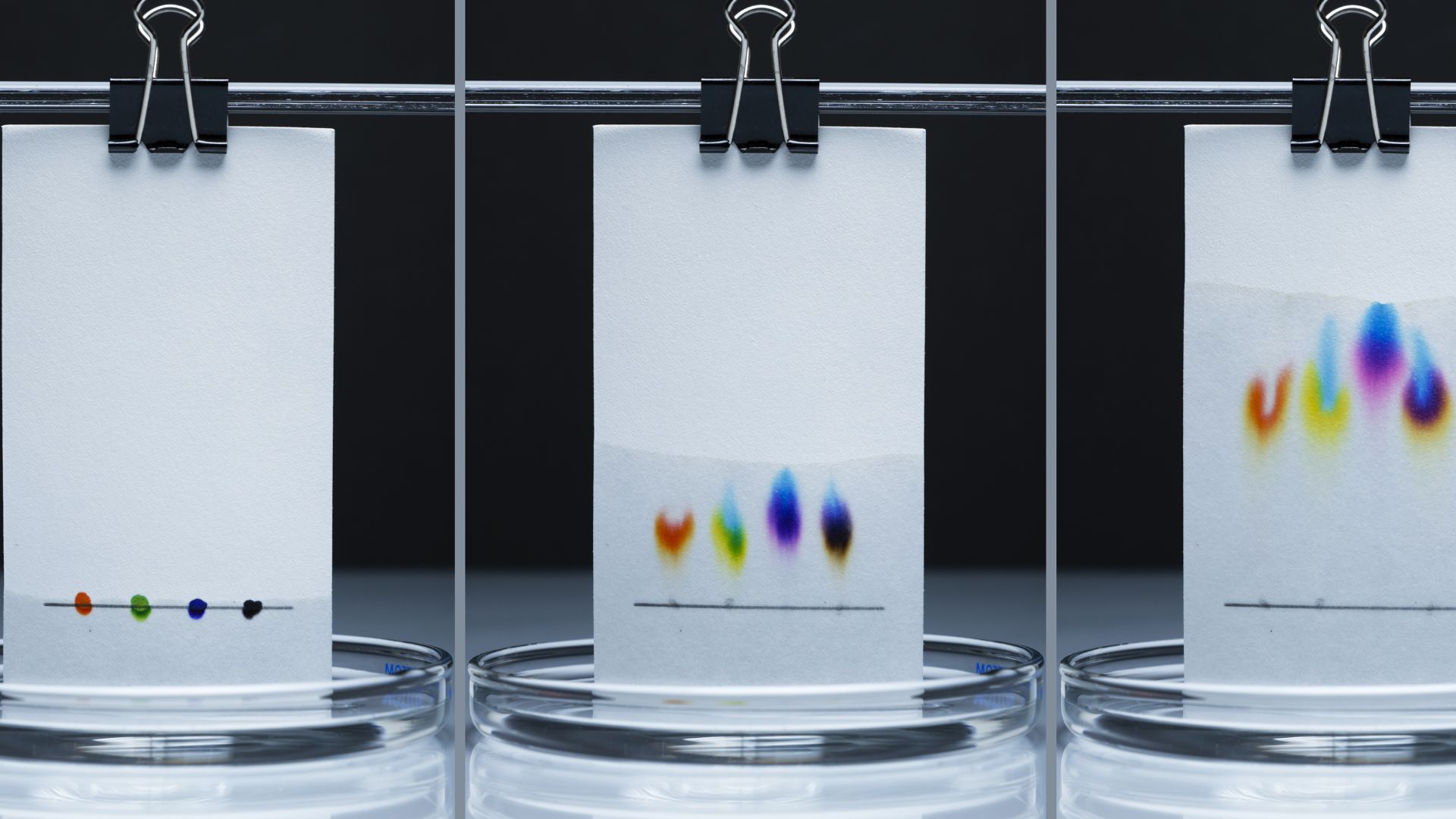

Diversification: Don’t Put All Your Eggs in One Basket

You’ve probably heard this before. But it’s worth repeating.

Diversification means spreading your investments across:

-

Different industries

-

Different countries

-

Different asset types

Why? Because not everything falls at the same time. If tech stocks drop, healthcare or consumer goods might remain stable.

Diversification reduces risk without sacrificing long-term growth.

Risk Management and Emotional Discipline

Investing isn’t just about numbers. It’s about psychology.

Understand Your Risk Tolerance

Can you sleep at night if your portfolio drops 20%? If not, you may need a more balanced approach.

Avoid Panic Selling

Markets will fall. It’s normal. Selling in fear often locks in losses. Historically, markets recover over time.

Think of market drops like turbulence on a plane. It feels scary, but it doesn’t mean the plane is crashing.

The Role of Research and Continuous Learning

Smart investors don’t stop learning.

Read Financial News Carefully

Avoid sensational headlines. Focus on fundamentals—earnings, growth, management quality.

Follow Trusted Principles

Rather than chasing trends, build strategies based on research and long-term data. Investors inspired by disciplined approaches, including principles often discussed around Payson Hunter, emphasize understanding before acting.

Ask yourself:

-

Do I understand this investment?

-

Does it fit my goals?

-

Am I reacting emotionally?

Passive vs. Active Investing

Passive Investing

This involves investing in index funds that track the overall market. It’s low-cost and simple.

Pros:

-

Lower fees

-

Less time required

-

Historically strong long-term returns

Active Investing

This means selecting individual stocks or timing trades.

Pros:

-

Potential for higher returns

-

More control

Cons:

-

Higher risk

-

More time and research required

For many individuals, a mix of both works well.

Tax Efficiency and Smart Planning

Taxes can quietly reduce your wealth.

Use Tax-Advantaged Accounts

Retirement accounts often offer tax benefits. Take advantage of employer matches if available. It’s free money.

Hold Investments Long-Term

Long-term capital gains taxes are usually lower than short-term rates.

Smart planning can add thousands—or even hundreds of thousands—to your lifetime returns.

Leveraging Compounding to Accelerate Growth

Compounding is like a snowball rolling downhill. It starts small, but as it grows, it picks up more snow faster.

When you reinvest dividends and returns, your money earns money on top of money.

Here’s the magic:

-

Invest early

-

Stay consistent

-

Reinvest gains

Even modest returns can become powerful over decades.

Avoiding Common Investment Mistakes

Let’s talk about what not to do.

Chasing Trends

If everyone is talking about a “hot stock,” it may already be overpriced.

Overtrading

Frequent buying and selling increases fees and taxes.

Ignoring Fees

Even a 1% difference in fees can significantly reduce long-term returns.

Lack of Patience

Wealth building isn’t fast. It’s steady.

Avoiding mistakes can be just as important as picking good investments.

Creating a Personalized Investment Plan

Your plan should reflect:

-

Your income

-

Your goals

-

Your risk tolerance

-

Your time horizon

Asset Allocation

Decide how much goes into:

-

Stocks

-

Bonds

-

Cash

-

Alternative investments

Younger investors often lean toward more stocks. As retirement approaches, shifting toward safer assets may make sense.

There is no one-size-fits-all strategy.

Monitoring and Adjusting Your Strategy

You don’t need to check your investments daily. In fact, that can cause stress.

Review Periodically

Once or twice a year is enough for most people.

Rebalance When Needed

If stocks grow significantly, they may become a larger part of your portfolio than planned. Rebalancing restores balance and controls risk.

Consistency matters more than constant changes.

Building Wealth with Patience and Consistency

If there’s one takeaway, it’s this: wealth building is a marathon, not a sprint.

Small, steady contributions. Thoughtful decisions. Emotional discipline.

Over time, these habits can lead to real financial freedom.

You don’t need to predict the next big thing. You need to stay committed. Investors who focus on structured, informed strategies—like those principles often associated with Payson Hunter—tend to prioritize research, patience, and long-term thinking over speculation.

Ask yourself today: What small step can I take right now? Maybe it’s opening an investment account. Maybe it’s increasing your monthly contribution. Maybe it’s simply learning more.

The journey starts with action.

Conclusion

Building wealth as an individual investor isn’t about luck or secret formulas. It’s about understanding your goals, managing risk, staying disciplined, and giving your investments time to grow. When you combine knowledge with patience, even modest contributions can turn into substantial wealth.

Inspired by structured and informed financial thinking—such as principles often linked to Payson Hunter—you can take control of your financial future. Start where you are. Stay consistent. Trust the process. Over time, your efforts can compound into something remarkable.